Here is a rewritten version of your text, organized into clear sections for better readability:

Navigating the Valuation of Private Tech Companies

In today’s dynamic market environment, investors are increasingly comparing private tech companies to their public counterparts. This comparison is crucial due to the high valuations and consistent performance of certain stocks like Snowflake. Here’s an overview of the factors influencing these valuations and a detailed analysis of Snowflake as a benchmark.

Understanding Valuation Challenges

Valuing private companies presents unique challenges, particularly in the tech sector where rapid growth and innovation are prevalent. Investors must consider several key factors when determining valuations:

- Cash Flow and Profitability: Positive free cash flow with significant reserves is essential for valuing private companies.

- Revenue Growth: Consistent revenue growth rates indicate sustained expansion potential.

- EV/Rev Growth: This metric provides insights into market expectations of future performance.

- Inflationary Pressures and Interest Rates: These factors can influence investor sentiment, affecting valuations.

Factors Influencing Valuation

Key factors that impact the valuation of private tech companies include:

- Cash Flow Position: Robust cash flow with adequate reserves is a critical factor.

- Revenue Growth Rate: A sustainable growth rate enhances investor confidence.

- EV/Rev Growth: This ratio reflects market expectations and investor sentiment.

- Inflationary Pressures and Interest Rates: These macroeconomic factors can significantly impact valuations.

Case Study: Snowflake as a Benchmark

Snowflake, with its robust financials and market presence, serves as an excellent benchmark for private tech companies. Here’s a detailed look at its valuation:

-

Key Metrics:

- NRR (Nonrecourse Risk): 178%

- Growth Rate: 101% year-over-year

- Scale: Over $1.5 billion annualized run rate

- Cash Flow Positive: Adjusted FCF margin of 28%

- Rule of 40: Highly diversified customer base with consistent growth and management excellence

-

Valuation:

- Snowflake currently trades at a 19.7x CY23E revenue estimate, which is considered conservative.

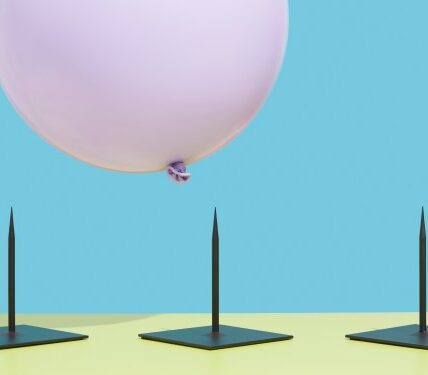

- Investors anticipate further declines in valuations due to inflationary pressures and shifting market dynamics.

Investing Implications

The current market environment presents both opportunities and challenges for investors:

- Opportunities: High valuations offer attractive entry points with significant upside potential.

- Challenges: Inflationary pressures and interest rate fluctuations can impact investor confidence, leading to further declines in private company valuations.

Future Outlook

While the market may experience corrections, stability is expected. Investors should remain vigilant but also patient as valuations adjust based on changing economic conditions and market sentiment.

This structured approach ensures clarity and logical flow, making it easier for readers to grasp the complexities of private tech company valuation.